New U.S. Tax Law Accelerates Income Tax Savings For Many Equipment Purchasers

by Jamie Gibson - Terex Financial Services On Mar 29, 2018, 03:00 AM

Subscribe To Aerial Pros

Filter by tags

Many businesses may be eligible for immediate and significant federal income tax savings from the full cost of equipment purchased and placed in service now. Eligible equipment includes construction products, such as mobile elevating work platforms (MEWPs), as well as those used in the agricultural industry, commercial trucks and trailers, office equipment and more.

This now also includes purchases of used equipment, providing opportunity to diversify fleet management strategies.

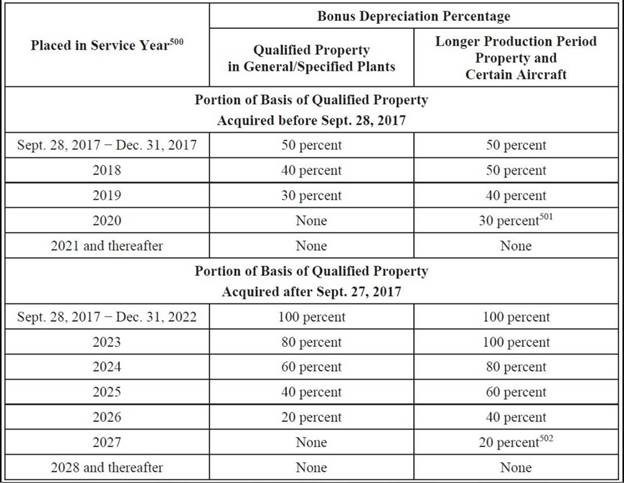

Bonus depreciation: In recent years, the percentage for first-year “bonus depreciation” deductions has fluctuated, complicating tax planning. Now the new law hikes the bonus depreciation deduction from 50% to 100% for five years and then gradually phases out the deduction over the next five years.

Section 179 deductions: Under Section 179 of the Internal Revenue Code, a business could expense up to $500,000 of the cost of qualified business property, subject to a dollar-for-dollar phaseout above $2 million. These figures were indexed for inflation.

The new tax law doubles the maximum allowance to $1 million and increases the phase-out threshold to $2.5 million. The benefit of electing section 179 expensing is eliminated through the end of 2022 due to the new 100% depreciation provisions.

Added bonus: The deduction has been expanded to include “used” property that otherwise qualifies under this provision.

In addition, for the first time, bonus depreciation also applies to "used" property purchased by a taxpayer. In other words, the property no longer needs to be first original use to qualify for bonus depreciation as long as it is "new" to the taxpayer.

Now may be the time for your company to purchase equipment and take advantage of the 100% depreciation benefit included in the Tax Cuts and Jobs Act. See the chart below for additional details about the bonus depreciation percentages:

Please contact your accountant, tax or financial professional advisor with regard to benefit in your individual situation.

Related Posts

Service Minute: The Importance of Technician Training Programs

Training in the aerial industry is very important — a life is at stake each and every time someone gets into a piece of aerial equipment.

Continue Reading

Service Minute: Aerial Equipment Reliability Tips

Having worked in the Genie® field and phone support for over 20 years, I’ve noticed a couple of things about machine reliability

Continue Reading